At Secerna, we understand the critical role intellectual property (IP) plays in fostering a robust innovation ecosystem. Government incentive programs like the Patent Box offer significant tax advantages specifically designed to encourage research and development (R&D) activities. This article provides a comprehensive overview of these programs and their potential benefits for your business, helping you unlock tax savings and fuel a culture of innovation.

Reduced Tax Rates for Patented Products and Processes

The Patent Box scheme allows qualifying companies to benefit from a reduced corporate tax rate on profits derived from patented inventions. This can translate to substantial tax savings on profits from your patented products or processes. These savings can be strategically reinvested into further R&D, accelerating innovation and technological advancements. Importantly, the Patent Box also extends its benefits to royalties received from licensing out your qualifying intellectual property rights.

Statistics

Data from the UK government's Patent Box relief statistics for 2021-2022 reveals a trend of increasing value of tax relief claimed despite a slight decrease in participating companies. This suggests larger companies are taking advantage of the program. According to the report, large companies, making up just 24% of those electing to the scheme, claimed a significant 94% of the total tax relief [1]. The manufacturing sector remains the biggest beneficiary, with over half the participating companies and 44% of the total tax relief claimed [1]. Interestingly, the data also highlights a regional disparity in Patent Box usage. London claimed the most relief (44%) despite having fewer participating companies compared to the South East (15% of companies) [1].

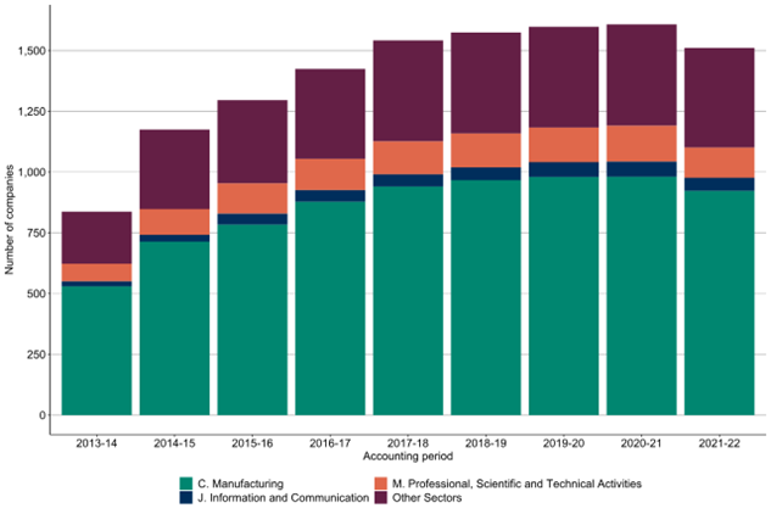

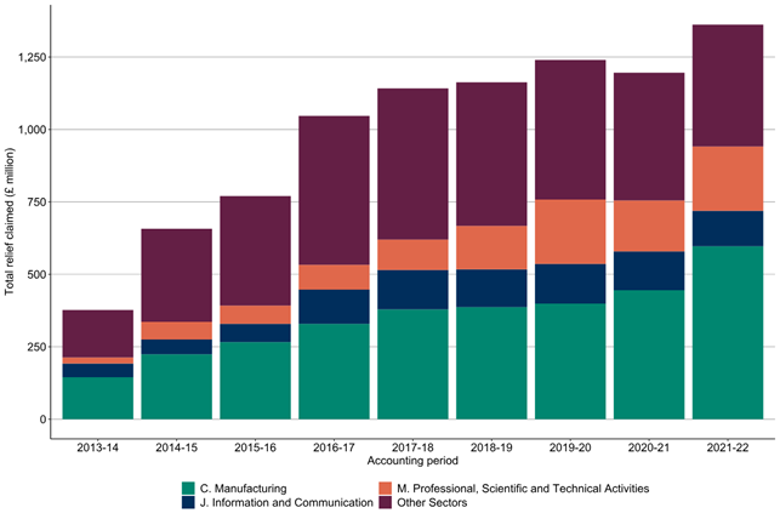

Figures 1 and 2 below display the total volume of companies by sector choosing to elect to the Patent Box and total value of claims from tax year 2013 to 2014 to tax year 2021 to 2022. Figures for tax year 2021 to 2022 are projections.

Figure 1: Number of companies choosing to elect to the Patent Box by sector from 2013-14 to 2021-22

Figure 2: Total amount of relief claimed by sector from 2013-14 to 2021-22

Maximizing the Benefits: Considerations for Your Business

While the Patent Box offers undeniable advantages, a thorough understanding of eligibility criteria and program specifics is crucial for optimal utilisation. Secerna can assist you in navigating this process:

- Eligibility Assessment: We can evaluate your company's IP portfolio and R&D activities to determine if you qualify for the Patent Box. It is important to note that eligibility criteria can be complex and depend on several factors. We recommend consulting with a tax advisor to assess your specific situation for the most up-to-date information on tax implications.

- Strategic Patent Prosecution: Our expertise in patent law ensures your inventions receive the strongest possible protection, maximizing the potential benefits you can derive from these programs.

- Invention Harvesting: We can assist in the identification of new inventions which may be eligible for the Patent Box enhancing possible tax savings for years to come.

Beyond Tax Savings: The Broader Benefits

The Patent Box offers more than just financial rewards. These programs can significantly enhance your business in several ways:

- Enhanced Global Competitiveness: A strong patent portfolio, coupled with significant tax savings, positions your company as a leader in innovation. This attracts investors and customers worldwide, propelling your business to the forefront of the global marketplace.

- Talent Acquisition and Retention: A focus on R&D creates a dynamic work environment that fosters continuous innovation. This environment is highly attractive to top scientific and engineering minds, aiding in talent acquisition and retention.

Unlocking Your Innovation Potential: The Next Steps

At Secerna, we are committed to helping companies like yours leverage the power of intellectual property to achieve their strategic objectives. Here is how to get started:

- Schedule a Consultation: Connect with our team to discuss your specific R&D activities and IP portfolio. We can assess your eligibility for the Patent Box and develop a tailored strategy to maximize the benefits for your company.

- Strengthen Your Patent Portfolio: Our team of patent attorneys can help you secure strong patents that maximize the value you can derive from the Patent Box.

- Explore Government Resources: The UK government provide detailed information on their Patent Box programs on their official website [2]:

- Consult with a Tax Advisor: For the most up-to-date information on tax implications and eligibility requirements specific to your company, consulting with a tax advisor is highly recommended.

By leveraging the expertise of Secerna and these government incentive programs, your company can unlock significant tax advantages and fuel a culture of innovation. This strategic approach will empower you to translate your ground breaking ideas into reality, driving your business towards a successful and sustainable future. Contact Secerna today.

[1] Patent Box relief statistics: September 2023 - GOV.UK (www.gov.uk)

[2] https://www.gov.uk/guidance/corporation-tax-the-patent-box